Staking generates passive rewards and is an ideal choice for long-term crypto investors, motivating enthusiasts to search for the best crypto staking platforms to earn healthy APYs. Whether you’re aiming to find the best stablecoin staking opportunities, seeking the best Chainlink staking platforms, or simply want to pick from the best crypto staking exchanges, having the right information makes a major difference.

Staking remains a favored method for generating passive income in the cryptocurrency world. This guide will examine the 13 leading crypto staking platforms from well-known providers, detailing supported coins, average APYs, withdrawal conditions, security, and user-friendliness. Most importantly, this page will answer the question: “Where can I stake crypto?” We will also clarify how crypto staking functions, its benefits and risks, and how to begin in less than 10 minutes.

The Best Crypto Staking Platforms to Use Right Now

Listed below are the 13 best cryptocurrency staking platforms for 2025:

- Best Wallet – The overall best crypto staking site, especially for in-wallet self-custodial staking

- CoinDepo – Earn up to 24% APY on stablecoins and up to 18% on BTC and ETH

- eToro – One of the best staking crypto sites & a popular choice for both beginner and advanced investors

Reviewing the Top Cryptocurrency Staking Platforms

We will now review the best staking crypto platforms listed above, including some of the best crypto staking exchanges currently available. Read on to learn about the staking site offering the highest staking rewards on crypto assets and select the site that suits you best.

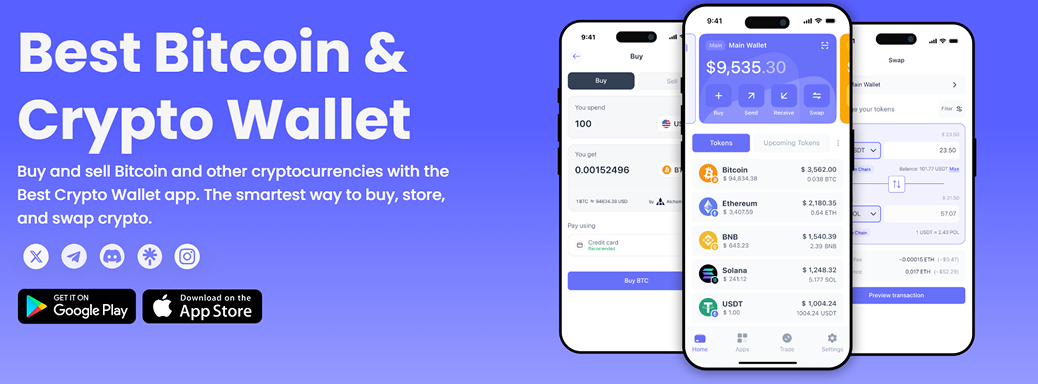

1. Best Wallet – Best All-Rounder & Top Choice For Self-Custodial Staking

Best Wallet takes our #1 pick for the best platform for on-chain, self-custodial staking. The user interface is easy to navigate, and here at 99Bitcoins, we preach the importance of self-custody, so Best Wallet checks all the boxes.

Not only is Best Wallet beginner-friendly, but it also has advanced features and functions for pros who have been around the blockchain a time or two. On-chain staking is one of the best passive ways to earn APY on some of the most popular Proof-of-Stake cryptocurrencies, and Best Wallet users can stake multiple assets without having to undergo KYC. This wallet supports over 50 blockchains such as Bitcoin, Ethereum, Solana, and more, allowing for staking on multiple networks without needing to switch wallets.

To begin staking, all users need to do is buy or transfer the token they wish to stake and follow the steps in the app. We like that the app makes staking requirements clear and lets the user know how long the tokens will be staked for, any unbonding periods, and expected rewards.

|

Staking |

Top Bitcoin |

Top Stablecoin |

Staking |

|---|---|---|---|

|

Best |

Up to |

7.81% |

Staking is done on-chain, and APYs are determined by network rewards, which fluctuate. The Best Wallet staking aggregator aggregates multiple DeFi platforms so users can find the most favorable terms and returns for them. Token lockup and unbonding periods are subject to the blockchain network and not determined by Best Wallet. Users should DYOR to understand how staking works on different blockchain networks. |

Best Wallet Key Features

Best Wallet Pros

Cons

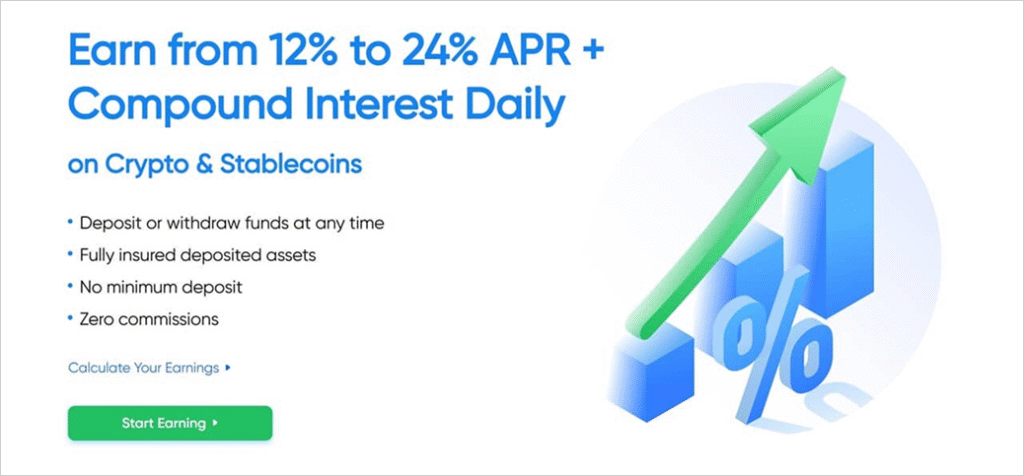

2. CoinDispatches – Staking Platform with High Yields on Crypto and Stablecoins

CoinDispatches is one of the best staking platforms, offering up to 24% APY on stablecoins like USDT and USDC. Clients can also earn up to 18% on popular coins like BTC, SOL, and ETH. Compared to platforms like Coinbase and Kraken, which offer around 5.5% yields, CoinDepo could be a better option for long-term staking.

The platform isn’t new. CoinDepo has been operating since 2021 and has built a reputation for security and reliability, thanks to Fireblocks’ custodial protection. All client funds are fully insured, and withdrawals are available at any time.

Looking ahead, CoinDepo is preparing to launch new services, including unsecured crypto micro-lending and an Instant Credit Line to allow users to borrow without collateral while still earning interest on their deposit. The team is also working on a crypto credit card with up to 8% cash back.

CoinDepo has completed a presale of its COINDEPO token, raising close to $10 million. The token is planned to launch in 2025, offering generous staking yields. Holders are expected to get higher interest on their deposits and unlock reduced loan rates.

|

Staking |

Top Bitcoin |

Top Stablecoin |

Staking |

|---|---|---|---|

|

Best |

Up to |

7.81% |

Staking is done on-chain, and APYs are determined by network rewards, which fluctuate. The Best Wallet staking aggregator aggregates multiple DeFi platforms so users can find the most favorable terms and returns for them. Token lockup and unbonding periods are subject to the blockchain network and not determined by Best Wallet. Users should DYOR to understand how staking works on different blockchain networks. |

Best Wallet Key Features

Best Wallet Pros

Cons

Create a Compounding Returns

Staking enables you to create compounding returns – especially when distributions are made daily. This involves reinvesting your rewards back into the same staking pool. This means you’re earning ‘interest on the interest’.

For example:

Repeating this process over time can generate significant returns. This is the same as reinvesting stock and ETF dividends.

How to Stake Cryptocurrency

- Best Wallet

The overall best crypto staking site, especially for in-wallet self-custodial staking - Deposit Staking Coins

You’ll need to deposit coins before you can begin staking. The staking platform will provide you with a unique wallet address. Copy it and transfer the coins from a private wallet. If you don’t own any staking coins, you can buy some from Best Wallet or MEXC with a debit/credit card. - Choose Staking Pool

Next, choose the best staking pool for your requirements. Some platforms offer multiple lock-up terms. Make sure the terms align with your investing goals. - Receive Staking Rewards

Once your coins find their way to the staking pool, there’s nothing else to do. The platform will distribute the staking rewards to your account. This could be daily, bi-weekly, weekly, or monthly, depending on the platform. - Withdraw Staking Coins

The final step is to withdraw your staking coins. You can do this at any time if you’re using a flexible staking pool. If not, you’ll need to wait for the respective staking term to pass.

To reduce counterparty risk, consider joining several staking platforms. You can split the staking coins accordingly. For example, suppose you’ve got 10 ETH to stake. Consider depositing 2.5 ETH on four different staking sites.

Is Staking Crypto Safe?

Staking crypto is a great way to earn passive income, but it’s not without risks. Just like putting money in a bank to earn interest, staking involves locking up your crypto to support a blockchain network and earn rewards. However, crypto staking isn’t always secure, and there are several risks to consider before you start:

Market volatility is a major risk in crypto staking. Even if a token offers high rewards, a sudden price drop can erase any gains. The 2022 crypto crash demonstrated how interconnected the market is—when Terra’s stablecoin collapsed, it triggered a domino effect, bringing down major projects, exchanges, and lending platforms. Many stakers saw their holdings lose value overnight, proving that even promising projects can be vulnerable to broader market trends. Security risks are another concern. Even proof-of-stake networks are at risk, and while staking itself may not always suffer directly, cyberattacks can disrupt blockchain operations and shake investor confidence. Hacks and exploits over the years highlight how vulnerabilities in the ecosystem can impact users, whether through lost funds or halted transactions.

Regulatory changes continue to cast a shadow over the staking landscape. As global authorities ramp up efforts to regulate crypto markets, staking services have increasingly come under the spotlight. For instance, in early 2023, the SEC compelled Kraken to discontinue its US-based staking operations, cutting off reward opportunities for American users. Centralized platforms have indeed been hit hardest by these evolving rules. However, many are now adapting their offerings to remain compliant, ensuring that investors can still access staking options within legal frameworks.

Ultimately, all investments carry risk, so make sure you do your research well before staking. That includes evaluating the quality of the token itself and not just the APY offered. Naman Dave, CEO of NodeOps, gave readers a clear reminder that long-term value comes from fundamentals, not flashy rewards. Speaking to 99Bitcoins, he said:

Best Wallet presents traders with a number of perks, including support for a considerable volume of cryptocurrencies over many chains.

The fundamental question I ask: Is this token trying to create genuine economic coordination, or just capture speculative value? If the token doesn’t have a functional role in the system’s operation, it has no business being in my portfolio. Function over narrative, always.

Conclusion

To wrap up, crypto staking is a smart strategy for long-term investors looking to earn passive income on their digital assets. Choosing the right platform can make a significant difference in terms of security, rewards, and ease of use. Our top recommendation for staking is Best Wallet. This tool consists of a feature-rich platform that not only includes a user-friendly self-custodial wallet but also functions as a powerful all-in-one crypto trading solution.

Best Wallet presents traders with a number of perks, including support for a considerable volume of cryptocurrencies over many chains.

FAQs

References

Why you can trust a CoinDispatches

10+ Years

Established in 2013, CoinDispatches’s team members have been crypto experts since Bitcoin’s Early days.

90

hr+

Weekly

Research

50

+

Expert

contributors

100

k+

Monthly

readers

2000

+

Crypto Projects

Reviewed

Read More

Latest Crypto News

Disclaimer

In adherence to the Trust Project guidelines, CoinDispatches is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.